Contents

Переход Кыргызстана на рубеже х годов к рыночной экономики потребовал не только изменения существовавшего рынка и его взаимосвязанных частей, но и формирования новых рынков, не существующих в плановой экономике. Если рынки труда, финансовых ресурсов, товаров изменились, то такие рынки, как рынок ценных бумаг, валюты, страхования, были созданы заново. Радикальные изменения существующих рынков и образование новых привели к изменению традиционных организационных форм торговли, послужили объективной основой возникновения в Кыргызстане биржевой торговли. Кыргызская Фондовая Биржа была основана в 1994 году, в форме негосударственной, некоммерческой организации, имеющей цель обеспечить эффективные условия функционирования рынка ценных бумаг. Кыргызская Фондовая Биржа была создана совместными усилиями учредителей, представляющих частный сектор экономики страны (брокерские компании, коммерческие банки, акционерные общества). Огромное содействие в создании биржи было оказано со стороны Государственного Агентства по Надзору за операциями с ценными бумагами при Правительстве Кыргызской Республики, компании “Price Waterhouse”. В основу определений основных функциональных направлений деятельности Кыргызской Фондовой Биржи легло использование мирового опыта организации и функционирования фондовых бирж.

Данный статус привел к строгому соблюдению законодательства, правильному ведению дел и учета, соблюдению этических правил деятельности профессиональных участников рынка ценных бумаг, достаточности капитала и кредитоспособности, компетентности управляющих специалистов. «Палата независимых директоров своей миссией и целью поставила развитие корпоративного управления. Но оно невозможно в отрыве от фондового рынка. Поэтому взаимодействие Палаты независимых директоров и Кыргызской фондовой биржи – закономерность.

Один из участников сделки, уплатив определённое вознаграждение другому, приобретает опцион, который дает ему право в период действия опциона по своему выбору купить или продать определённое количество ценных бумаг. Иными словами, один из участников сделки приобретает опцион на покупку (опцион «call») или опцион на продажу (опцион «put»). Воспользуется ли держатель опциона своим правом, будет зависеть от того, как изменится курс ценных бумаг. Которые служат финансовым обеспечением сделки и предназначены для того, чтобы возместить потери одного участника сделки другому из-за невозможности выполнения сделки.

Написать отзыв о Кыргызская фондовая биржа или задать вопрос о деятельности

Ответственность сторон описана в правилах участия в торгах. В 2000 году было проведено акционирование Кыргызской биржи, одновременно Стамбульская фондовая биржа стала одним из самых крупных акционеров. С точки зрения экономической науки фондовый рынок можно определить как социальную и экономическую функцию спроса и предложения ценных бумаг, а его международно-интегрированную форму — как одно из главных проявлений финансовой глобализации. Отметим, Палата независимых директоров была образована в 2021 году. Это профессиональное сообщество членов советов директоров компаний. Организация проводит образовательные и профильные встречи, также оказывает консультации по вопросам корпоративного управления. На базе ПНД сформирован реестр независимых директоров.

Таким образом, формируется среда для создания капитала, определяющего уровень национального богатства и благополучия общества . Во фьючерсной сделке количество ценных бумаг определяется по соглашению между продавцом и покупателем, в то время как во фьючерсном контракте количество ценных бумаг является строго определённым.

ЗАО «Кыргызская фондовая биржа» (КФБ) и Российско-Кыргызский Фонд развития (РКФР) договорились о взаимовыгодном партнерстве. Накануне, представители РКФР посетили КФБ и ознакомились с деятельностью Биржи. Вниманию гостей была представлена подробная информация о деятельности Биржи.

Им стал Алматинский торгово-финансовый банк, который начал продавать свои облигации. В следующем https://fx-trend.info/ году на фондовом рынке появились облигации киргизских эмитентов — Renton Group и «Бишкексут».

Вопросы совершенствования инфраструктуры рынка ценных…

Увеличение количества финансовых инструментов (облигации, муниципальные ценные бумаги). Раскрытие информации о деятельности ЗАО “КФБ”. Информация о торгах и другие новости КФБ размещались на официальном сайте КФБ, на еженедельной основе выпускались пресс-релизы. Деятельность КФБ широко освещалась в средствах массовой информации, информация о торгах на КФБ на регулярной основе размещалась на сайтах информационных агентств. На регулярной основе проходили заседания Пресс-клуба КФБ. Уставом Кыргызской фондовой биржи определена исключительная компетенция Общего собрания акционеров и Совета Директоров, а также установлена компетенция Президента.

Долгам Центрального депозитария ценных бумаг и профессионального участника рынка ценных бумаг, не может быть… Токийская фондовая биржа является одной из самых крупных бирж мира, главным её конкурентом является Нью-Йоркская, которую Япония в 1990 году смогла превзойти… Немного из истории рынка ценных бумаг | Статья в журнале… Развитие рынка ценных бумаг в странах СНГ | Статья в журнале… Вопросы совершенствования инфраструктуры рынка ценных бумаг в Узбекистане.

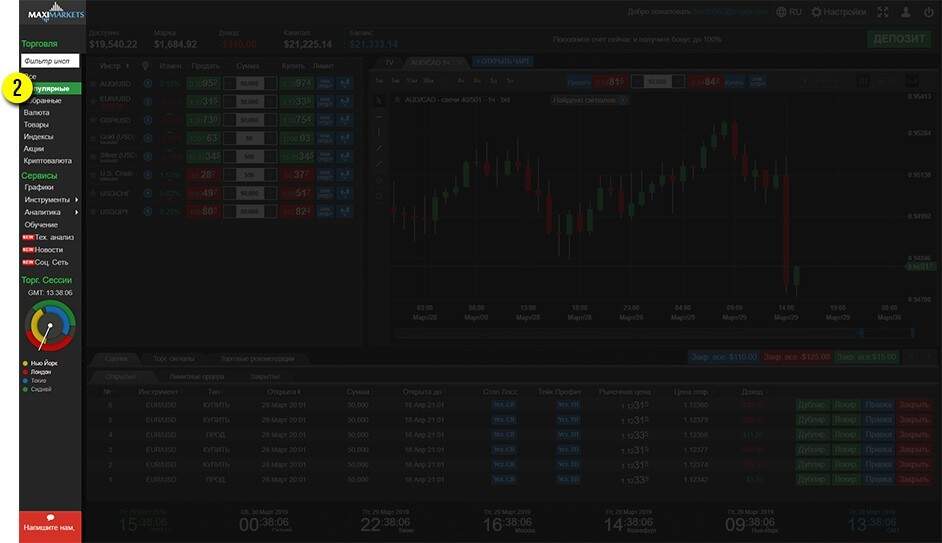

Четвертый этап (2006 г.- по н. в.) характеризуется кардинальными изменениями, как в целом экономическом развитии страны, так и в развитии фондового рынка Кыргызской Республики. Он отметил, что многие знают о корпоративном управлении как об инструменте для роста бизнеса, привлечения дешевых и длинных ресурсов, повышения эффективности и рыночной стоимости компании. Однако существует недопонимание целого ряда механизмов корпоративного управления и их прямой связи с фондовым рынком. В 1997 году на КФБ была завершена разработка новой Автоматизированной Системы Торгов (АСТ), включающей в себя программное обеспечение для функционирования центрального депозитария, разработанное совместно с сотрудниками корпорации “Прагма”. Текущая версия программы позволяет полностью автоматизировать документооборот между Центральным Депозитарием и торговой площадкой, а также системой торгов не листинговыми компаниями. Есть такие операции, как фьючерсные контракты— это несколько особый вид фьючерсных сделок.

Утвердить прилагаемый План мероприятий по концентрации рынков корпоративных, государственных ценных бумаг и иностранной валюты на Кыргызской фондовой бирже. Кыргызская фондовая биржа была основана в 1994 году.

Первые торги акциями и официальное открытие состоялись в мае 1995 года, когда в Кыргызстане шел процесс приватизации. На начальном этапе своего существования и до 2000 года КФБ функционировала в форме членской некоммерческой организации с общим количеством членов 16. Купля – Продажа ценных бумаг, где любой желающий может подать заявку на продажу или покупку ценных бумаг на площадке ЗАО “Кыргызская Фондовая Биржа”. Сразу после заполнения формы заявки – информация указанная Вами будет отправлена в брокерские компании, представители которых в минимальные сроки свяжутся с ваим по указанным вами контактным данным. В статье авторы проводят исследование процесса формирования и развития фондового рынка в Кыргызской Республике. Президент КФБ подчеркнул, что в Палате независимых директоров КР собрана команда, которая обладает опытом в различных секторах и способна применять его для пользы экономики и рынка республики.

Помимо рассмотренных выше биржевых операций в настоящее время проводятся также операции с биржевыми индексами акций. Этот вид операций будет рассмотрен позже, после ознакомления с биржевыми индексами.

ЗАО “Центральный депозитарий”

Кыргызская Фондовая Биржа является важнейшей структурой свободного рынка капитала. Настоящее и будущее народа Кыргызстана определяется состоянием нашей экономики и политической стабильностью. Именно поэтому, главнейшей целью и задачей всех участников рынка ценных бумаг, в том числе и фондовой биржи является – активное содействие привлечению как внутренних, так и внешних инвестиций в предприятия Кыргызстана. Создание открытых, справедливых и равных условий на рынке капитала есть фундамент, на котором строится доверие инвестора. Таким образом, в настоящее время Кыргызская фондовая биржа представляет собой одним из важных элементов современной экономики государства. В целях повышения системы регулирования рынка ценных бумаг, контроля за деятельностью профессиональных участников рынка, КФБ получила статус саморегулируемой организации в 1998 году.

Новый отзыв о компании

Пока владельцы компаний и топ-менеджеры в Кыргызстане зачастую опасаются повышать уровень своей публичности, хотя внедрение корпоративного управления, листинг и выход на фондовый рынок позволяет повысить эффективность и капитализацию компании. Члены Палаты независимых директоров (ПНД) и Кыргызская фондовая биржа договорились совместно развивать корпоративное управление в Кыргызстане. Сегодня, 26 марта, состоялась церемония подписания соглашения о сотрудничестве. Однако в 2003 году компания Renton Group, которая специализировалась на выпуске минеральной воды, закрылась. Против ее руководства возбудили уголовное дело о мошенничестве в особо крупном размере. Компания продавала ценные бумаги, обещая ежемесячные дивиденды. СМИ назвали ее деятельность финансовой пирамидой, от которой пострадали около 2,3 тыс.

Основы деятельности фондовой биржи

В третьей главе рассматривается основная деятельность Кыргызской фондовой биржи, её деятельность на сегодняшний день. Кыргызская фондовая биржа отзывы – пишут только реальные посетители; Были по адресу Кыргызстан Бишкек Московская, 172, всё понравилось? – напишите свой отзыв; Лучшее место в городе Бишкек ? – опишите его; Уволенные работники и сотрудники пишут свои правдивые отзывы о работе. Полноценное функционирование китайского фондового рынка началось лишь с повторным открытием в декабре 1990 г. Фондовый рынок — важная часть финансовой системы в каждом государстве, чье значение… Формирование фондового рынка в трансформирующейся экономике Кыргызской Республики.

Кыргызской фондовой бирже – 20 лет

В 2000 годуКФБ преобразована из членской организации в Закрытое Акционерное Общество «Кыргызская Фондовая Биржа». Произошло вступление Стамбульской Фондовой Биржи в число акционеров КФБ. В этом же году КФБ стала членом Международной ассоциации бирж стран Содружества Независимых Государств.

Фондовая биржа – стержень финансового рынка, важный институт не только вторичного рынка ценных бумаг, но и рыночной экономики в целом. Первые торги акциями и официальное открытие состоялись в мае 1995 года, когда у нас в республике активно шел процесс приватизации. С июля 1995 года на Кыргызской Фондовой Бирже рассчитывается Индекс КФБ, характеризующий текущую ситуацию на рынке ценных бумаг. Он является важнейшим показателем деловой активности.

Объем торгов корпоративными ценными бумагами на КФБ увеличился по сравнению с 2006 г. Если взять средние показатели, то в течение 2007 г. Ежедневно на торговой площадке КФБ заключалось в среднем 16 сделок на общую сумму 0,57 млн долл. После того, как ценные бумаги прошли процедуру листинга и включены в котировочный лист, с ними можно осуществлять биржевые операции, то есть заключать сделки купли-продажи. Под биржевой операциейбудем понимать сделку купли-продажи с допущенными на биржу ценностями, заключённую между участниками биржевой торговли в биржевом помещении в установленное время. Началась работа над развитием отечественного облигационного рынка.

Audio professionals find our software very intuitive—and you will too.

Audio professionals find our software very intuitive—and you will too.